Please join Yeosijae as we build a brighter future for Korea. Create your account to participate various events organized by Yeosijae.

- Insights

- |

- Sustainability

- Future Industries

Barriers prevent South Korean companies from joining RE100

Speedy reforms are needed to put South Korea’s Green New Deal on track for success

‘RE100’ or 100% renewable electricity will determine business competitiveness

President Moon’s Green New Deal is an Ambitious Project;

However, It Fails to Provide Answers to Key Questions.

On May 20th, President Moon Jae-In shared his vision for a “K-New Deal.” He stated, “it is clear that the Green New Deal is the way for us to go,” and ordered it to be added to the third supplementary budget. Through his remarks, the government was able to demonstrate its strong commitment to climate action and affirm its intentions to invest in climate-related industries and job creation, and this determination is expected to revive stalled energy transition initiatives.

The Green New Deal is a transformative national project that emerged against the backdrop of a deep economic recession due to COVID-19 and a growing sense of urgency around climate change, and it aims to reduce carbon emissions while simultaneously create jobs. The government has pledged to make wartime level efforts to implement measures throughout all sectors of our society over the next ten years to decarbonize the Korean economy. In fact, South Korea plans to cut emissions in half by 2030 in the short term and transform its energy mix to source 100% of the country’s electricity consumption from renewables in the long run, primarily from solar and wind power. To achieve these goals, the government has outlined ambitious plans to adopt innovative technologies, such as energy storage systems (ESS) and electric vehicles (EV), at a national level.

However, there are hurdles that we must overcome first, and regrettably, the government’s new initiative fails to address the most critical issues.

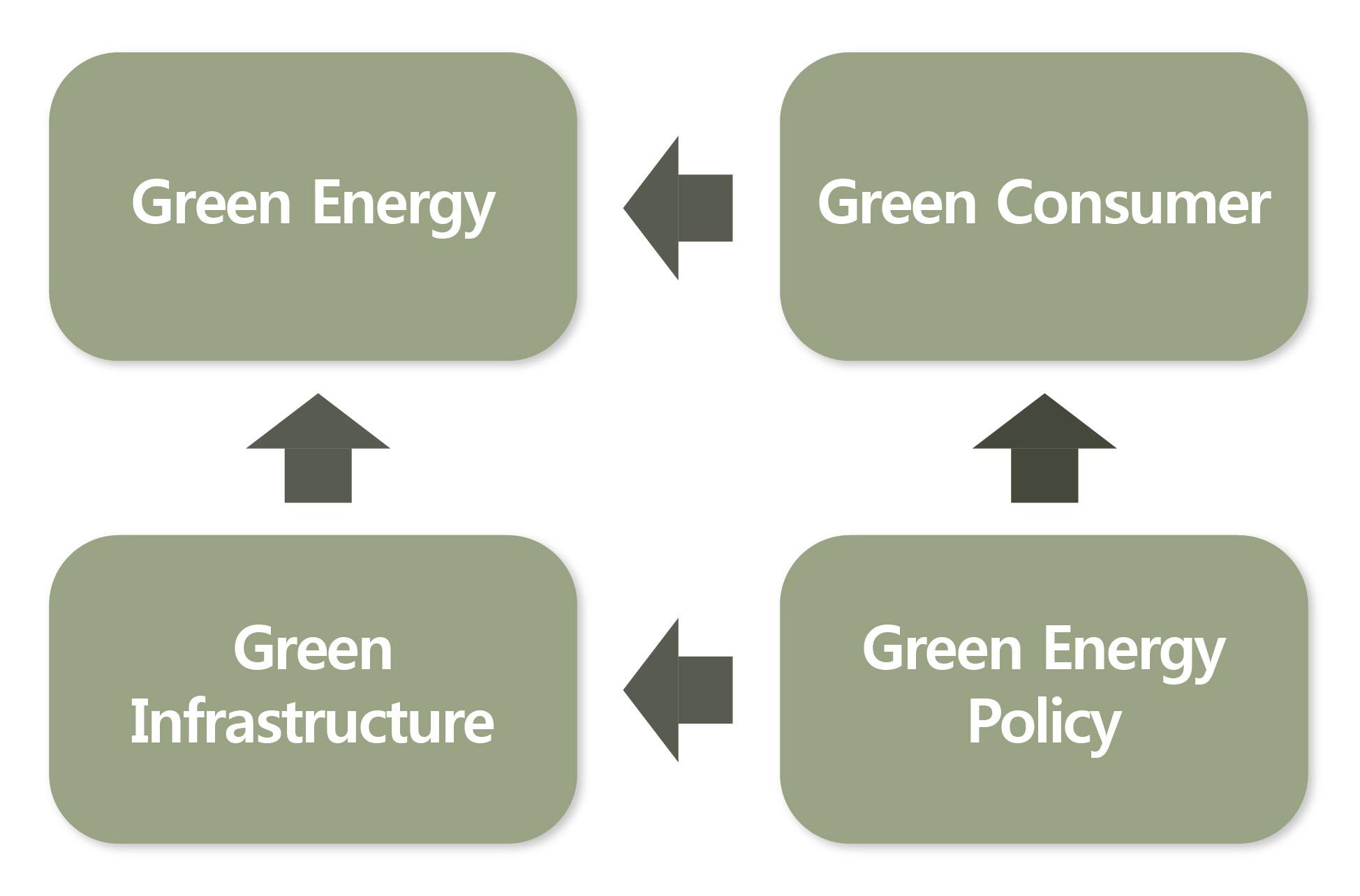

Infrastructure for Green Energy:

Who Will Fund It, When, and How?

First and foremost, the Green New Deal (GND) overlooks problems that surface in adopting green energy systems. While the plans address green energy deployment and topics related, it does not contain measures that outline the details of how it will facilitate green energy adoption. Just as high-speed trains require high-speed rail networks to run properly, green energy deployment would need corresponding infrastructures to be built in advance or concurrently. Establishing such infrastructure demands significant investment and effort, and on this account, the government’s initiative must include answers to questions about where the funds will come from, who will build the infrastructure, and when it will be provided.

Another issue with the new initiative is that it fails to raise issues related to green energy consumers. Much of the discussions in GND focus on energy distribution, and there is little consideration for who will buy the energy and how it will be used. For the successful implementation of GND policies, the government must communicate an unequivocal message for green energy transition and increase the participation of consumers (i.e., industries and the public). Without consumer participation, government investments could be for naught, like pouring water into a sieve, incurring considerable costs with little results.

Must Generate Public Consensus On

Electricity Pricing Reforms

Third, the vision lacks measures on cost structure reforms for energy, especially for electricity generation. Currently, renewables are a more expensive source of energy compared to fossil fuels, and unless this gap is narrowed, consumers will find it difficult to switch to green power. In this vein, the government must provide a roadmap to reduce green power generation costs in the future to increase public awareness on the long-term benefits of the energy transition.

Lastly, the GND initiative fails to recognize that new policies must be introduced to achieve the goals it has laid out. Energy transition has been slow in Korea not because of technology or resource insufficiency, but because of policies that have hampered progress. If you examine other advanced nations that are proactively adopting green energy sources into their energy mix, policy reforms have preceded large-scale public and private investments, and the government’s stance on energy transition has remained consistent over different administrations. As such, policy reforms must come first to boost consumer and investor confidence and to create an ecosystem with a virtuous cycle, where confidence leads to investments.

The Korean government has yet to offer solutions to the aforementioned issues, and without prompt actions to present clear, concise answers, skepticism around the Green New Deal will only grow over time.

RE100 is Essential to Compete On a Global Level

235 Global Businesses Have Joined the Initiative

30 Companies, including Google and Apple, Have Already Achieved 100% Renewable Electricity

One of the most important factors in creating the virtuous cycle is consumer participation. Consumers of green energy can largely be divided into two groups: industrial and residential consumers. And for those on the industrial side, ‘RE100’ will emerge as an important keyword. RE100, or renewable energy 100%, refers to a campaign where companies make commitments to source 100% renewable electricity for all of its operations. As of June 2020, a total of two hundred thirty-five companies have joined the campaign globally, and they aim to achieve their goals by 2050. Thirty companies in particular, including business rivals for Korean IT businesses in the global market such as Google and Apple, are already using 100% renewable electricity. Consequently, I believe that participation in RE100 will become an important factor of competition for Korean IT businesses. Soon, companies that have not joined the campaign will be marked as “enemies of clean energy,” and this is bound to hamper cooperation with RE100 members.

Last Month, LG Chem Became the First Korean Company

to Join the RE100 Initiative

Despite these circumstances, South Korea had zero RE100 member companies until July 2020, when LG Chem announced its plans to become carbon neutral. Considering the situation, one could ask why South Korean companies are late to join the RE100 campaign. The answer can be found in the challenges of the Green New Deal, as outlined above. Companies that generally seek to go carbon neutral use the following procurement methods to source renewable energy: (1) self-generation of renewable electricity, (2) direct procurement from off-site grid-connected generators through power purchase agreements (PPA), (3) purchase of renewable energy certificates (REC), and (4) green pricing programs.

According to the statistics, self-generated electricity accounted for less than 4% of the total renewable energy procurement in 2018. In contrast, PPA and green pricing methods accounted for 20% and 30%, respectively, while certificate purchases were the most preferred approach, with 40% of the share.

For South Korean companies, however, self-generation of renewable energy is the only available procurement method, as policy constraints prohibit the use of certificates and green pricing programs. As a result, South Korean companies have no means to pursue RE100 initiatives, even if they are willing to bear the costs of the energy transition, and this stands as the greatest obstacle to RE100 participation in Korea.

Samsung Electronics Postponed Energy Transition in Korea

But Has Reached 100% Renewable Energy Overseas;

Policy Limitations Hinder Efforts to Participate in RE100

Samsung Electronics is a case in point. In June 2018, Samsung announced renewable energy plans and pledged to participate in the RE100 campaign. However, it is yet to implement measures to begin the process domestically. To comply with its own promise, the company reviewed various measures to expand the share of renewable energy, but it is still struggling to initiate action due to the challenges mentioned above. In contrast, oversea branches of Samsung are expected to achieve 100% renewable electricity by 2020 through the two methods of certificate purchases and green pricing programs. In short, South Korea faces an ironic situation where one of its most outstanding global businesses, like Samsung, is unable to take part in the RE100 initiative domestically, though it has already achieved its goals in foreign countries. Consequently, the government must make policy reforms first to achieve the goals of the GND. Without reforms, there will be no Green New Deal.

Korea Has to Adopt New Energy Technologies;

However, the Country Has No Cost Management Plan for New Infrastructure

Large-scale grid integration of renewable electricity, such as solar and wind, requires new grid infrastructure. This, by no means, refers to a simple extension of the existing electricity transmission network. What we need are new technologies for power generation, including large-scale ESS, independent power systems like micro-grids, and direct current (DC) distribution systems. At the moment, South Korea’s Green New Deal does not outline the costs of new infrastructure, nor does it mention which stakeholder will shoulder the expenses incurred. Under the current regulatory framework, renewable power producers are expected to foot the bill for not only the power generation equipment, but also the majority of costs incurred during the integration process. Thus, without regulatory reforms, it would be a challenge for any investors to consider entering the renewable energy sector. Metaphorically speaking, the situation would compare to manufacturing companies covering the costs of not only the construction of factories, but also the roads for the procurement of goods, and such obligations would discourage any company from investing in new business operations.

New Deal projects are originally intended to expand social overhead capital (SOC) through direct public investments. In this context, the Green New Deal could be interpreted as a government initiative that aims to provide public investment to build infrastructure for green energy adoption. Consequently, the government should entrust the provision of green energy to the private sector and focus more on expanding green SOC investments. In other words, a clear political commitment to infrastructure development is required to promote private participation in green energy.

The Government Should Utilize the 5.2 Trillion Won

Electric Power Industry Basis Fund

South Korea has what is called an Electric Power Industry Foundation Fund, which is financed by additional charges levied on electricity sales (equivalent to 3.7% of the electricity bill) and renewable portfolio standard non-compliance penalties. Its purpose is to create a foundation for the sustainable development of the electric utility industry. Article 49 of Chapter 5 of the Electric Utility Act states that the Fund shall be used to implement “projects for supporting entities engaged in new and renewable energy power generation business and projects for improving the link condition of the electric power system of new and renewable energy under the Act on the Promotion of the Development, Use and Diffusion of New and Renewable Energy.” Since the establishment, the Fund has continued to accumulate its reserves, holding roughly 5.2 trillion won as of 2019. The government must promptly tap into the Fund’s resources to show its resolve to develop green energy infrastructure. Doing so will boost public confidence in Green New Deal policies, and the market will naturally respond to this change.

Public Utility Companies like KEPCO

Should Spearhead Participation in Green Energy Initiatives

Considering the structure of South Korea’s electric power industry, the responsibility for long-term infrastructure development falls on public enterprises. However, the current regulatory framework stipulates that energy-related public companies, including KEPCO and other energy producers, should focus solely on expanding the existing alternating current (AC) power grid. Investing in new infrastructure for green energy under this circumstance would contradict the regulatory objectives of public enterprises, and without change, public utility companies will continue to be discouraged from pursuing such projects. The government must fast-track speedy reforms to pave the way for state-owned entities to invest in green energy infrastructure. Only then will public companies endeavor to participate in projects for long-term infrastructure development.

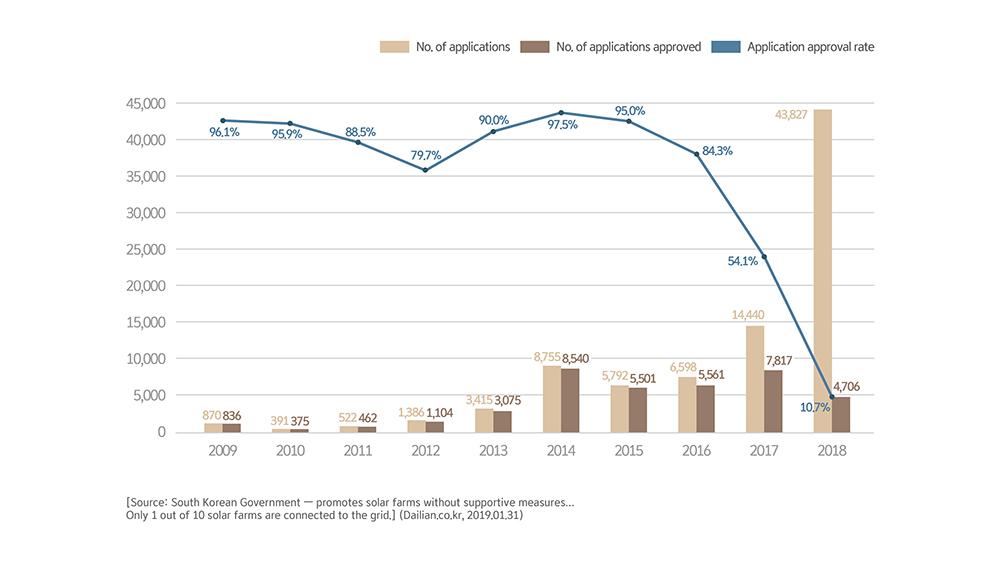

Under the current regulatory framework, renewable energy companies are required to go through KEPCO to connect to the grid. However, grid-connection applications have increased exponentially over the past few years, and this has forced KEPCO to approve only a small number of applications (10.7% as of 2018) due to limited capacity. For this reason, we must urgently pursue regulatory reforms that will allow KEPCO to take the initiative to invest in green energy infrastructure projects.

Fossil Fuel Versus Green Energy;

Grid Parity Will Occur in 2026

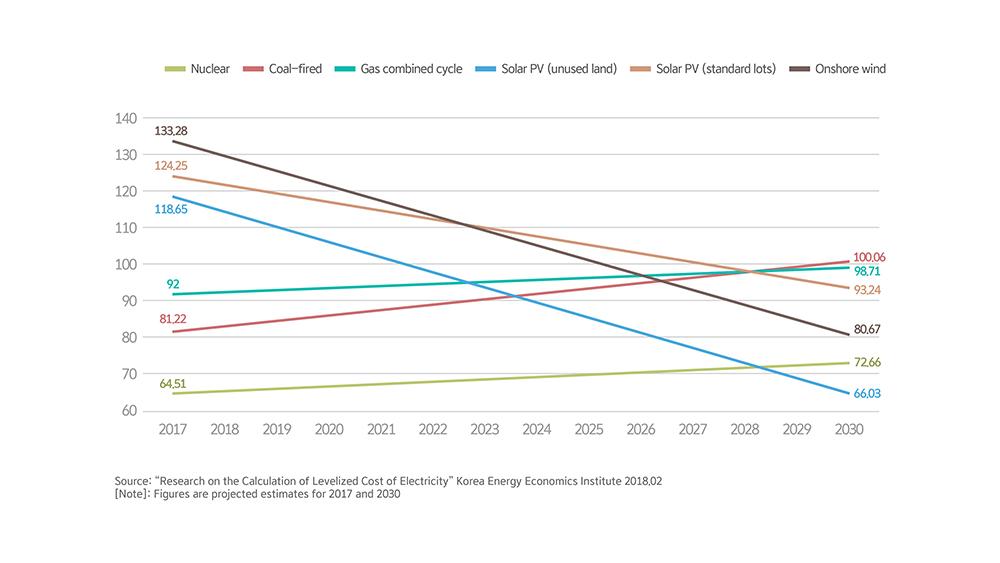

The price of renewable electricity has fallen sharply over the years compared to fossil fuel energy. Electricity from solar power today costs roughly a fourth of the price paid ten years ago, dropping from 430 won/kWh to 120/kWh. According to projections from the Korea Energy Economics Institute (KEEI), renewable power generation costs will continue to drop in the future to reach the levels below fossil fuel by 2026 for large-scale renewable energy generation.

Establishing Green Energy Zones &

Accelerating Green Energy Cost Reduction

Through the Green New Deal initiative, the government should accelerate cost reductions for renewables. Establishing green energy zones is key to this process, and I believe that the southwestern coast of Korea, which includes the provinces of North and South Jeolla, is best suited for this project. It is my hope that this region would be designated as the “green energy belt” for the development of a large-scale green energy complex that utilizes solar and wind power generation. Furthermore, I would like to urge the Korean government to ensure that it will leverage the Electric Power Industry Foundation Fund to build the necessary infrastructure. These efforts together will accelerate cost reduction for green energy production.

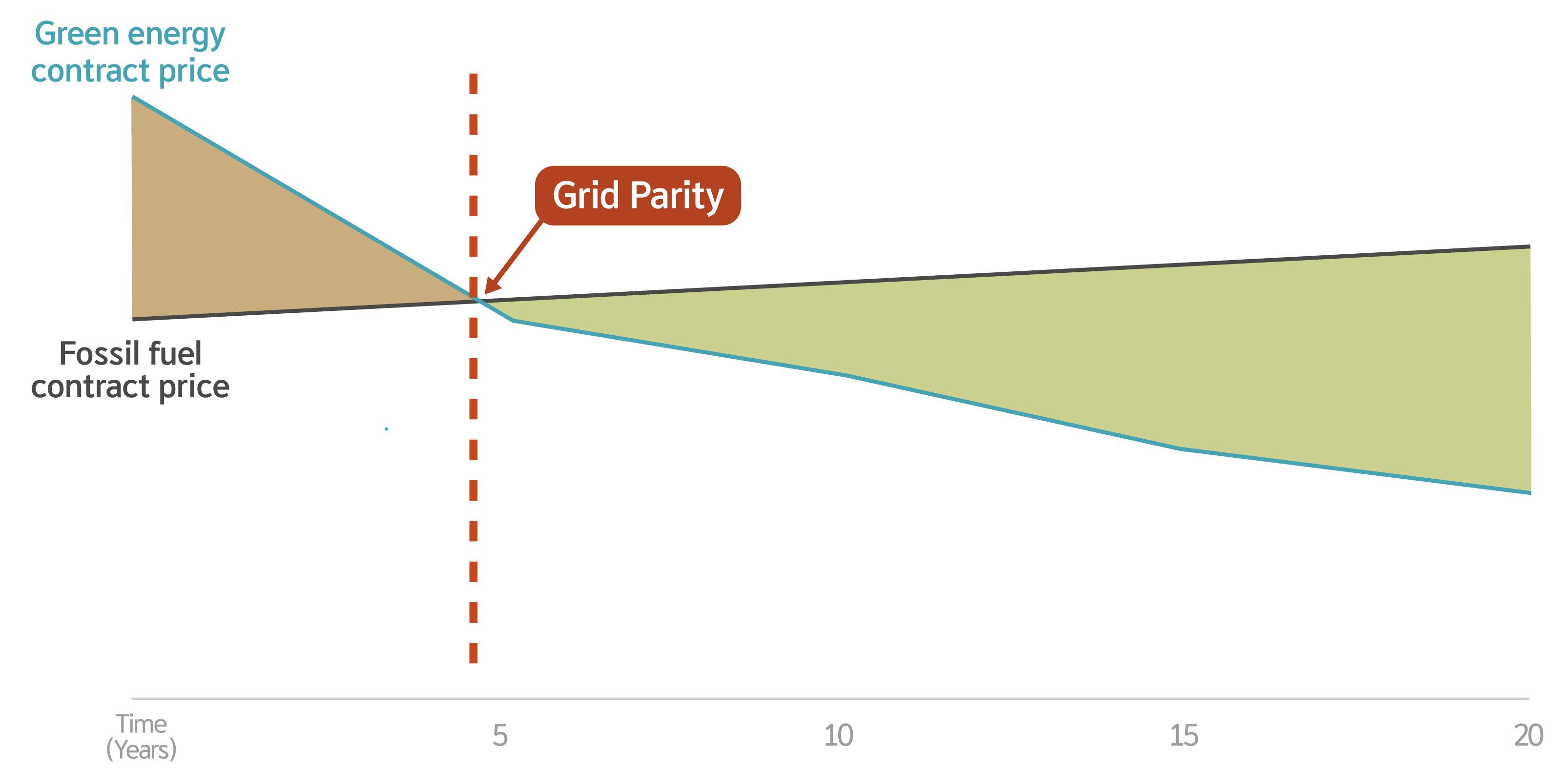

As mentioned before, the cost of power generation from green energy sources are currently more expensive than fossil fuels. However, if renewable energy is made cheaper than traditional energy sources within the next five years, power suppliers could attract green energy consumers through long-term contracts. Though these users will have to initially pay higher rates for electricity, they stand to benefit financially in the long run as prices fall over time. This is why there is a need for the government to demonstrate its commitment to green energy through the GND initiative to accelerate the advent of grid parity. Ultimately, presenting clear roadmaps could allow more businesses to join RE100 and increase consumer uptake of green energy.

Corporate and Public Uptake of Green Energy Will Determine Success

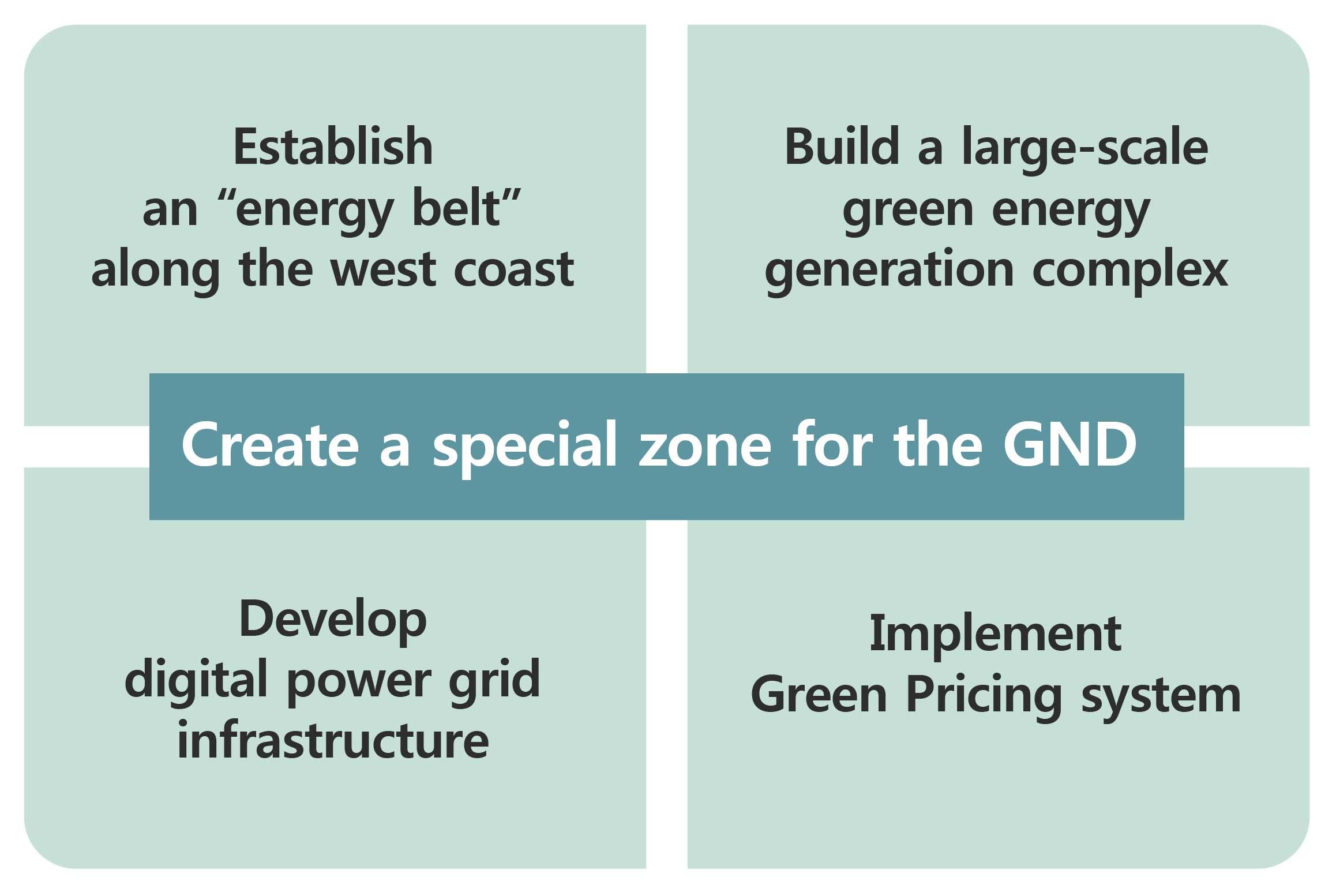

Currently, South Korea is working to pass legislation to support the Green New Deal. Taking this into account, I would like to conclude by proposing the following suggestions for the new regulatory framework.

First, a GND special zone should be established to enable the development of large-scale green energy production complexes and facilitate the trade of energy produced in the region. To this end, I believe that the west coast of Korea would be the most appropriate location to pursue such initiatives.

Second, the government should assume responsibility for green energy infrastructure development and adopt new technologies in the field, including ESS, micro-grids, EV charging-discharging system, and DC transmission and substation technologies. Moreover, the government should prioritize the use of the Electric Power Industry Foundation Fund to finance development projects and compel state-run enterprises, including KEPCO, to make long-term efforts to develop green energy infrastructure through regulatory obligations.

Third, the government must create an environment that encourages active RE100 participation. Companies seeking to join the campaign should have access to the electricity generated in the special zone through the green pricing system. Furthermore, the government should conduct public campaigns to boost public participation and increase the uptake of the green energy system.

Finally, the new framework should take into consideration that the suggestions mentioned above cannot be put into action under the current electricity pricing system. The Korean government will have to make gradual changes to introduce a pricing mechanism that will facilitate the adoption of green energy. As the first step toward progress for South Korea, the government should implement the green pricing system in the special zone to accelerate the adoption of green energy and facilitate the transition into the Green New Deal era.

|

About Seung-Il Moon |

This text was originally published on Yeosijae’s Korean homepage on August 18th, 2020.

< Copyright holder © TAEJAE FUTURE CONSENSUS INSTITUTE, Not available for redistribution >