Please join Yeosijae as we build a brighter future for Korea. Create your account to participate various events organized by Yeosijae.

- Insights

- |

- Northeast Asian Regional Community

[The Great Energy Shift] The scramble for energy supremacy in East Asia: the US, Russia and China

Towards a Natural Gas Trading Hub as National Agenda

“Unless something is done, Korea will suffer collateral damage”

The US and Russia are keeping an eye on East Asia

The Great Energy Shift is approaching, and the upcoming changes will have a significant impact on the future of Korea. Unless something is done, Korea will suffer collateral damage from the battle for supremacy between others.

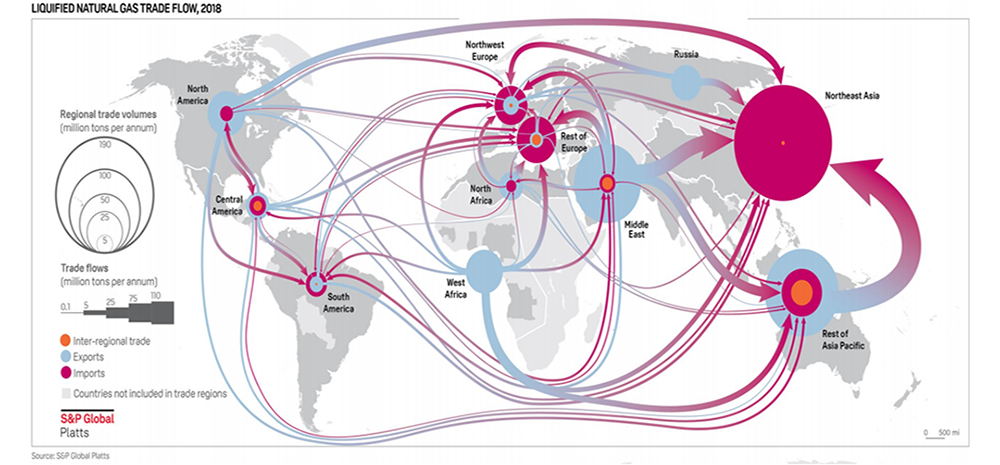

The Great Energy Shift is unfolding across three dimensions. The first is digital transformation. The spread of digital technologies has led to higher electricity consumption. Natural has is currently the primary energy source that produces electricity. That is why we say that an ‘age of gas’ is coming. The second dimension is the transition from fossil fuels to renewable energy. Changes in these two dimensions will continue over the next 20-30 years. The third dimension is related to changes in the US natural gas market. The US currently has an excess supply of natural gas. America has succeeded in revolutionizing the production of shale resources and the time has now come to to sell these resources overseas. China‘s commitment to import U.S. natural gas was mentioned in the US-China trade agreement. Outside of China, the US is also keeping an eye on East Asia, particularly Korea, Japan and Southeast Asia. To this end the US initiated the ‘US-Japan-Australia Energy Alliance’ to complement the nation’s Indo-Pacific strategy. At the same time, Russia is also observing the situation in East Asia. Russia is ‘weaponizing’ Siberian natural gas and preparing to compete with the US to become the number one energy supplier in the region. It is highly likely that the US and Russia will engage in a fierce battle on the East Asian battlefield over the next 10-20 years. The Great Energy Shift is a phenomena that happens only once in decades and consists of geopolitical change as well as changes to industrial and energy demand-supply structure.

The next 1-2 years are critical

What measures should be taken? Yeosijae has explored the impacts of the Great Energy Shift on international relations, with a particular focus on East Asia and Korea, and came to the tentative conclusion that it is necessary to establish a natural gas trading hub as a response to these ongoing challenges. On February 4, Yeosijae hold an open discussion titled “How can we build a gas trading hub in Northeast Asia?” at the National Assembly of the Republic of Korea.

Shon Ji Woo, Analyst at SK Securities, Lee Jong-Heon, Correspondent at S&P Global Platts and Park Heejun, CEO & President of Energy Innovation Partners (EIP), who are members of the Yeosijae Energy Research Team, gave key presentations during the event. Government officials, representatives from public corporations and energy companies and researchers also took part. Among the discussants were Yang Ki-wook, Head of the Gas Division at the Ministry of Trade, Industry and Energy (MOTIE), Ahn Se Hyun, Professor at University of Seoul, Kim Kisoo (Head of the Marketing Division, Korea Gas Corporation (KOGAS), Moon Jin-Young (Head of the Southeast Asia and Oceania Team at the New Southern Policy Department, Korea Institute for International Economic Policy (KIEP), Kim Hyun Tae (Resources Development & Recycling of Resources Program Director at Korean Institute of Energy Technology Evaluation and Planning (KETEP) and Kim Gene J.W., former Korea Business Representative of Delfin LNG. The discussion was moderated by Kim Younkyoo, Professor at Hanyang University, who heads the Yeosijae Energy Research Team.

All participants agreed that a critical period is coming, and responsive measures should be taken at the national level. Establishing the gas hub requires finding solutions not only to internal issues, but also to geopolitical changes, relationships with energy traders and other issues. That is why the participants recognized the necessity to start from current needs and move step-by-step in a way that demonstrates tangible results to other countries. The next 1-2 years are especially critical.

Lee Kwang Jae, President of Yeosijae, suggested the establishment of the ‘Seven-Party Energy Ministers Meeting’ with participation from energy consumers and suppliers, Korea, China, Japan, North Korea, the US, Russia, and Mongolia.

The Open Discussion was co-hosted by Yeosijae and the Northeast Asia Coexistence and Economic Cooperation Research Group at the National Assembly of the Republic of Korea (co-chaired by Rep. Kim Boo Kyum and Rep. Kim Tae Nyeon), organized by Rep. Shim Ki Joon and supported by the Presidential Committee on Northern Economic Cooperation.

[The following is a summary of the main points discussed]

Korea will remain on the periphery unless it makes a decision

Participants concurred that the future of Korea will depend on the consequences of the Great Energy Shift. Establishing a gas trading hub would help Korea progress from a resource poor to a resource rich country.

However, experts also expressed concerns that if Korea remains passive in terms of decision-making and taking action, as has been the case so far, it will not only remain on the periphery of the global energy market but also runs the risk of suffering the most in a fight over energy issues between the US, China and Russia. Above all, participants unanimously agreed that the priorities should be overcoming the loser’s mentality, uniting efforts between the government and the private sector, starting to implement goals from small targets and improving system and infrastructure to gain the trust of the global market.

Global energy flows are shifting towards East Asia

As the main power source for data processing, gas has great potential to lead the global energy market in the era of AI, autonomous vehicles, smart cities and other inventions from the Fourth Industrial Revolution. Moreover, the US and China are accelerating the emergence of the age of gas. The US is consistently increasing domestic production and consumption of cheap shale gas and very soon will emerge as the world’s largest LNG exporter. Meanwhile, China is reducing coal consumption, significantly increasing imports of LNG and PNG, and developing its own shale gas production. Above all, global energy flows (gas flows) are shifting from the Middle East and Europe to East Asia, where Korea is the main logistics center. This is a great opportunity for Korea to establish a gas hub. (Shon Ji Woo, Analyst at SK Securities)

Overcoming the loser’s mentality

Northeast Asia has been paying up to 5-6 times more than the market price for gas due to the absence of a gas hub in the region. When it comes to building a gas hub in Northeast Asia, Korea is the only country that can provide benefits to not only consumers (Korea, China and Japan), but also to suppliers including the US and Russia. (Lee Jong-Heon, Correspondent at S&P Global Platts)

Considering the currently global supply and demand for LNG, the next one or two years are the right time to establish a gas hub and consumer-led LNG projects in Northeast Asia. Many US LNG export and trading companies have confirmed their willingness to supply commodities and invest if a hub is created in Korea. From the point of view of US shale gas companies, expanding the market more important than protecting existing markets or increasing margins. (Kim Gene J.W., former Korea Business Representative of Delfin LNG)

In order to create a gas hub, Korea has to gain the confidence that it has the best conditions to do so. The global energy hubs in Singapore and the Netherlands were not in a better situation than Korea when they launched their hub projects. With the world-class professionals, expertise and infrastructure of the Korea Gas Corporation (KOGAS), the world’s largest gas purchaser (3,500km of gas pipelines, storage facilities and terminals), as well as 1000 trillion won in National Pension Fund assets, Korea has the potential to become a major player in the global gas market. KOGAS should shift its focus from the domestic market towards a greater emphasis on exports and overseas investment. We need to break the mold and think outside the box. KOGAS should operate as the project manager that facilitates the participation of private companies in building the hub, and invest not only in the creation of the Northeast Asian hub but also in overseas gas hubs as well. The Japanese firm Osaka Gas has already demonstrated a good example of this by investing in the US Free Port. (Park Heejun, CEO & President of Energy Innovation Partners (EIP)

Make a list of regulations and tax obstacles to be solved

For these purposes, regulatory reforms are necessary. Domestic gas pipes, storage facilities and terminals should be available to private and foreign companies. The reasons why Singapore became an oil hub are very simple. In Singapore, everything is open and both domestic and foreign companies can trade freely. A hub cannot be established without opening up finance, including foreign exchange trading. This is the shortest way to make Korean finance more competitive. The tariffs also must be changed. Under the current system, additional tariffs would have to be paid every time gas comes or goes from the hub. Moreover, if gas is re-exported, two of the four taxes are non-refundable. If the volume of gas temporarily stored in Korea changes slightly through the natural vaporization process, this currently represents a violation of pending tariff legislation. In addition to this, the taxation system, which is based on 200,000-ton containers, should be adjusted in consideration of those importing and exporting smaller quantities. (Park Heejun, CEO & President of Energy Innovation Partners (EIP), Kim Gene J.W., former Korea Business Representative of Delfin LNG, Kim Hyun Tae, Resources Development & Recycling of Resources Program Director at Korean Institute of Energy Technology Evaluation and Planning (KETEP), Kim Kisoo, Head of Marketing Division, Korea Gas Corporation (KOGAS)

Infrastructure must also be improved. Korea possesses world-class gas import infrastructure, but there is no gas export infrastructure. It is not costly to develop. Preparation on this should start immediately. At the same time, potential recipients of gas exports should also develop their gas infrastructure. The problem is that there are no regasification terminals or gas pipelines in Indonesia, other Southeast Asian countries and the Eastern regions of China. Korean companies are globally competitive in this field and can provide services in this respect. The construction of necessary infrastructure for the numerous islands in Southeast Asia could be provided in a package that includes floating storage regasification units (FSRU), offshore piping networks, power stations, power transmission networks and smart cities. This would create synergy with Korea’s New Southern Policy. In early 2019. Japan’s Mitsui, Marubeni, and other companies already started constructing FSRU and natural gas power plants as part of a package deal in Indonesia. Japanese companies are the first-movers. In addition to the physical infrastructure, virtual infrastructure also needs to be created. Along with the development of the Korean Price Index (tentative name for the KOGAS index), it is necessary to set up financial infrastructure that will enable over-the-counter (OTC) derivatives and futures contracts. (Kim Kisoo, Head of Marketing Division, Korea Gas Corporation (KOGAS), Park Heejun, CEO & President of Energy Innovation Partners (EIP)

There are only 300 experts driving the world LNG market. Let’s cooperate with them!

We need to train experts in this field! We need professionals that are able to skillfully handle the system of gas trading and pricing for global importers and exporters. However, this does not require a large number of people. In reality, there are only about 300 experts driving global LNG trading. The same person can play the role of both a supplier and a buyer. The first step is training a small group of experts who can interact with them. (Park Heejun, CEO & President of Energy Innovation Partners (EIP), Kim Gene J.W., former Korea Business Representative of Delfin LNG)

Geopolitical issues also should be taken into consideration for the creation of a gas hub in Northeast Asia. The choices that Korea makes in geopolitical conflicts such as the US Indo-Pacific strategy, China’s Belt and Road Initiative and the LNG export policies of US and Russia will be very important We need to focus not only on Northeast Asia, which is currently the largest gas-consuming region, but also adopt a wise approach to the US-China conflict in the Mekong River basin in Southeast Asia, which is a potential large consumer of gas. The Mekong region is the area where the US Indo-Pacific strategy and China’s Belt and Road Initiative may clash with each other. (Ahn Se Hyun, Professor at University of Seoul, Yang Ki-wook, Head of the Gas Division at the Ministry of Trade, Industry and Energy (MOTIE)

Korea as a game changer?

Everybody agrees that it is necessary to build a gas hub in Northeast Asia and make Korea a game changer in the global energy market while also preparing for the future. Everybody agrees that a favorable environment for this is currently taking shape. The government and KOGAS are already working on a long-term strategy, and gradual liberalization of the system and regulations is expected. The public and private sector should combine their efforts and share knowledge to identify what is needed and make step-by-step improvements. (Kim Kisoo, Head of Marketing Division, Korea Gas Corporation (KOGAS), Yang Ki-wook, Head of the Gas Division at the Ministry of Trade, Industry and Energy (MOTIE)

Participants stressed the necessity of improving internal systems first. In order to establish the gas trading hub, a suggestion was put forward to create a list of regulations to be solved and initiate discussions on tax policy reforms in the National Assembly. This should involve creating new rules rather than lifting the barriers of the existing system. It was also mentioned that discussions should be held on upgrading financial systems and the costly issue of reorganizing terminals. In particular, the participants agreed that government involvement was necessary on issues such as how to attract suppliers from the US and Russia and involve consumers in Southeast Asia. Otherwise, the gas hub will not succeed. Attendees also noted that building up experience is important, even if it is only small transactions.

Yeosijae Energy Research Team will continue its work on researching the creation of a natural gas hub, including the analysis of internal systems. Discussions on these issues will be open to the public through upcoming events.

< Copyright holder © TAEJAE FUTURE CONSENSUS INSTITUTE, Not available for redistribution >