Please join Yeosijae as we build a brighter future for Korea. Create your account to participate various events organized by Yeosijae.

- Insights

- |

- Future Industries

Let’s Build an Innovative Ecosystem for SMEs and Startups

- A large gap in innovative capacity exists between conglomerates and SMEs

- Korea should nurture ‘reserve’ businesses that can lead future innovation

- There is a need to stimulate angel investment through bold tax benefits

Countries and Corporations that Succeeded in Innovation

Now Lead the Global Economy and Occupy Dominant Positions

The fact that innovation is an essential component for the survival and continued growth of corporations is old news. It was back in the 1940s when Joseph Schumpeter first noted that technological innovation through ‘creative destruction’ enabled the development and continuity of the capitalism economic system. In historic terms, after the first Industrial Revolution that began in the United Kingdom in the 1780s, the countries and companies that succeeded in innovation throughout the second and third revolutions came to lead the global economy and establish a dominant position for themselves.

Innovation has been a major talking point ever since the advent of the capitalism economic system. The reason innovation is attracting attention now is that the Fourth Industrial Revolution is developing in a way that differs from the previous industrial revolutions. As the Fourth Industrial Revolution unfolds across borders at unprecedented speed based on digital technology, it appears that the first movers will win the spoils.

Innovation is Directly Linked to Survival in the Fourth Industrial Revolution

Closing the Gap Through Imitation Has No Chance of Success

In his book Korea’s Time, professor Kim Tae-yu compares the Fourth Industrial Revolution with the previous revolutions in the following terms: ₁

“The Industrial Revolution era was a ‘North Star’ era.

You could determine which way to go from any location by referring to the North Star.

The key industries were energy, textiles, machinery, chemicals and steel.

In the first half of the Industrial Revolution, the UK revolutionized coal, metallurgy and fabrics...

but you could always succeed by following and benchmarking these key industries.

But the North Star era has now been replaced by the ‘Milky Way’ era.

In the Fourth Industrial Revolution era, the types of industries are as vast as the stars in the Milky Way, including artificial intelligence, big data, digital, biotechnology and nanotechnology.

It’s an era in which countless new industries are always appearing and dying out.

Key industries no longer exist, and this is not an era where you can succeed by simply copying certain industries in advanced countries.”

In the Fourth Industrial Revolution, ‘imitation’ is not a viable next-generation strategy for reducing the gap with the advanced group of nations. Survival is directly linked to who is the first to innovate, and how.

Korea’s National Capacity for Innovation is Top Class

Ranked No.1 in the 2021 Bloomberg Innovation Index

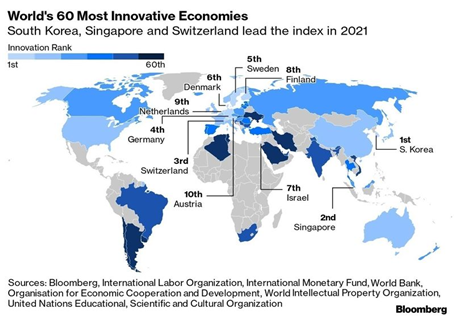

Assessments of Korea’s capacity for innovation are largely favorable. In the 2021 Bloomberg Innovation Index, Korea was picked as the most innovative country in the world. Singapore and Switzerland came in at second and third, and this is the seventh time Korea has earned the top spot since the index was first released in 2013. ₂

This index looks at seven metrics in total, which consist of R&D concentration, added value in the manufacturing industry, productivity, cutting-edge technology concentration, education efficiency, research concentration, and patent activity. The statistics from each category are transformed into an index to reach a final score. Korea was the only country out of 60 surveyed to receive a score of over 90, ranking first in the world.

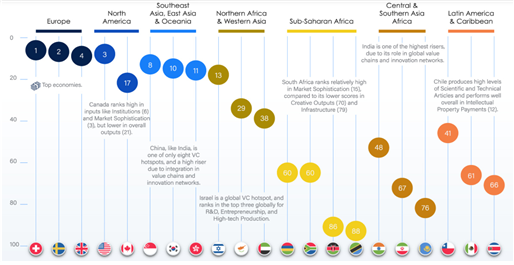

In the 2020 edition of the The Global Innovation Index, conducted by the World Intellectual Property Organization (WIPO) in partnership with Cornell University and the French university INSEAD, Korea ranked inside the top ten for national innovation capacity. ₃ The following is a tabulated diagram of countries separated by region.

Korea also came in at 13th in the World Bank’s 2019 Global Competitiveness Index. More specifically, Korea ranked even higher for the ‘innovation capability’ metric, which is related to corporate innovation, coming in at fifth. ₄

Samsung Electronics, LG Electronics and Hyundai Motor

Included in ‘Most Innovative Companies’

Three Korean companies placed inside the top 50 in the 2021 edition of the annual Most Innovative Companies report released by the Boston Consulting Group (BCG), with Samsung Electronics, LG Electronics and Hyundai Motor ranking 6th, 12th and 39th, respectively. The list is calculated based on a 30% weighting assigned to surveys of officials from the same industry, 30% for surveys of officials from other industries, and 40% for total shareholder return (TSR). Except for 2011, Samsung Electronics has been included every year since 2005. Notably, the Korean conglomerate even climbed to second in the world in 2013. LG jumped six places from 18 to 12 in 2020, while Hyundai Motor reentered the list after an eight year absence since 2013. ₅

Walmart, Disney and Other Companies From Traditional Industries

Also Included as Innovation Leaders

As expected, the Big Four American tech giants (Microsoft, Apple, Google and Amazon) took the top four spots. Notably, while Norvatis was the only pharmaceuticals or biotechnology company to make the list in 2020, seven companies from this industry were included this year, including Pfizer, Merck, Moderna and AstraZeneca. This appears to be due to the impact of the COVID-19 pandemic. Another point of interest is that innovation is not the exclusive domain of tech companies. Many companies from traditional industries such as Walmart, Nike and Disney are also innovation leaders.

Samsung Electronics, LG Electronics, SK Telecom, LS Electric and KAIST were included in the 2021 Top 100 Global Innovators index compiled by Clarivate (an intellectual property firm that split off from Thomson Reuters), which includes research institutes and corporations and is mainly based on patent-related data. Samsung Electronics, LG Electronics and LS Electric made the list for the first time in more than ten years. ₆

Is ‘Innovation’ Exclusive to Conglomerates?

Korea Need to Nurture ‘Reserve’ Innovation Leaders for the Future

Korea is known to have world-class capacity for innovation at the national level. Some assessments even place Korea at the very top. The same is true for the innovative capacity of Korea’s top-rated companies. One of the sub-categories evaluated by BCG is technology hardware, in which Samsung Electronics is second only to Apple (in the 2020 edition).

But are Samsung Electronics and LG Electronics the only companies that exist in Korea? According to the National Statistics Office (NSO), there were four million enterprises in Korea as of 2019. Not all of them are the kind of businesses we commonly refer to as companies. According to NSO statistics, Korea was home to 5,000 or so conglomerates, 100,000 medium-sized enterprises and 340,000 small enterprises as of 2018.

How does innovation look if we exclude the tiny percentage of elite companies? The reason for examining innovation in SMEs lies in the fact that the Big Four tech companies which currently lead the global economy all started out as SMEs in the 1980s and 1990s. Google has now been around for more than 20 years. It is common knowledge that these companies all started out as small businesses run out of a garage.

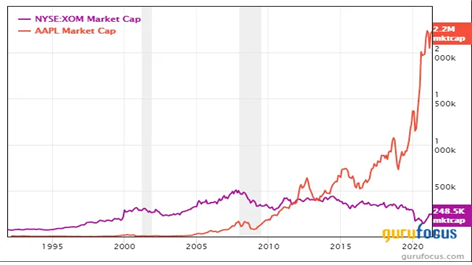

Figure 4 below compares the market capitalization of Exxon Mobil, the highest valued company on the US stock exchange in 1989, with Apple, the current leader in terms of market cap.

The speed and scope of change in the Fourth Industrial Revolution is light years from anything we saw 30 years ago. It will be difficult for countries to achieve sustainable economic growth and prosperity unless new innovative leaders continue to emerge. Korea needs to develop a batch of new ‘reserve’ businesses from the countless ranks of SMEs that are capable of leading innovation in the future.

A Huge Gap in Innovative Capacity Exists

Between Korea’s Conglomerates & SMEs

The Science And Technology Policy Institute (STEPI) has continued to study and analyze innovation in Korean companies over the past two decades. The Korean Innovation Survey (KIS) is a national approved statistic for studying and analyzing the innovative activities of Korean companies. After being launched in 1996, the survey was designated as a national approved statistic by the NSO in 2003. ₇

The KIS released at the end of 2020 was based on a sample of 4,000 Korean companies. It was carried out in a structured online format through web surveys of individual companies. The survey defined ‘innovation’ as new or radically improved products or business processes.

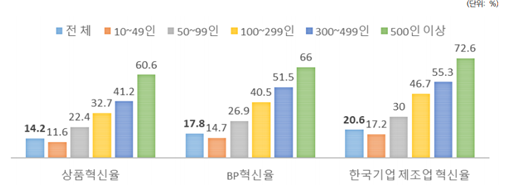

According to the KIS, the rate of product innovation in the Korean manufacturing industry was 14.2%, with figures of 17.8% and 20.6% for business process innovation and overall innovation, respectively. This was a substantial decline from the 2018 figure of 44.6% While the pandemic and minor adjustments to the survey system may have contributed to this result, the European Community Innovation Survey (CIS) conducted in the same period (2018) produced figures of 67.8%, 63.2% and 63.1% for Germany, Italy and Sweden, respectively. Compared to this, Korea’s report card looks lackluster.

The findings of this survey are starkly different from the glowing reviews received by Korea in evaluations of national innovative capacity and conglomerates. This appears to be due to the gap in innovative capacity between conglomerates (companies with 500 or more employees) and SMEs. This gap can be seen in the detailed findings of the KIS survey. While the innovation rate was 72.2% among conglomerates with at least 500 employees, the figure for companies with 50 or fewer employees was only 17.2%.

2020 Korean Innovation Survey: Manufacturing section, p76)

Boosting the Innovative Capacity of SMEs is an Urgent Issue

Korea Needs to Create Favorable Conditions for Startups to Become Innovation Leaders

The problem is obvious. The innovative capacity of SMEs needs to be improved. In the current structure where innovation is concentrated among conglomerates, there is no way for new industries to appear and respond to the growing changes brought about by the Fourth Industrial Revolution, let alone take the lead. In particular, Korea needs to create conditions conducive to helping venture businesses, including startups, lead industrial innovation.

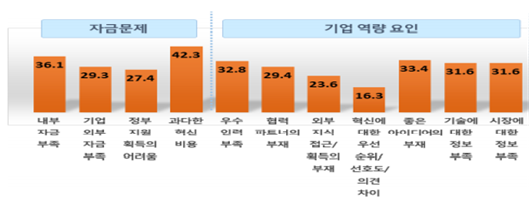

What are the factors undermining corporate innovation? One of the first topics usually mentioned on this issue is excessive government regulations. However, regulations are a double-edged sword when it comes to innovation. In the food industry and industries related to environmental issues, regulations can actually help to stimulate innovation.

The Environmental, Social and Governance (ESG) system that is drawing attention in recent times is a regulation at heart, but it is also boosting the sustainability of social and economic systems through corporate innovation. Furthermore, it is difficult to claim that regulations are the primary factor holding innovation back. What is the number one impediment to innovation? Figure 6 below outlines the obstacles to innovation that companies identified in the KIS survey.

(Source: Science And Technology Policy Institute,

2020 Korean Innovation Survey: Manufacturing section, p94) (unit: %)

Early Stage Capital Shortages Require Urgent Solutions

Angel Investment Needed to Help Companies Survive ‘Death Valley’

The first issue is capital. Capital is akin to the lifeblood of companies. In particular, ‘death valley,’ the colloquial term for capital shortages experienced during the early stages of a startup’s existence, is the starting point for an innovative ecosystem. Venture capital investment in Korea reached 4.3045 trillion KRW in 2020, the largest figure ever recorded. ₈ Beating out the 2019 figure of 4.2777 trillion KRW, Korea ranked fourth in the world in terms of venture capital as a percentage of GDP, only trailing the US, Israel and China. ₉

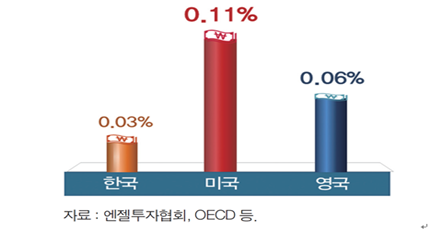

The unfortunate part is the lack of angel investment that could help companies get through death valley. Statistics from 2018 show that angel investment in Korea accounted for just 0.03% of GDP, one fourth of the US figure of 0.11%, and only half that of the UK. Of note, although the UK ranks lower than Korea in terms of venture capital investment as a proportion of GDP, the opposite is true for angel investment.

(Source: A Plan to Boost the Venture Ecosystem by Stimulating Angel Investment,

Jeon Se-hee, KIET Monthly Industrial Economics, June 2020 edition p66)

This signifies that capital flows are skewed in Korea’s venture ecosystem. From this, we can see that stimulating investment in the early stages of a startup’s life cycle is an issue that requires urgent attention.

Bold Tax Incentives are Needed

For Angel Investment Across All Stages

To grow the angel investment market, bolder tax benefits should be offered for angel investment. Under the current system, tax deductions are only granted at the point of investment. Korea’s system is an outlier in comparison to the US, UK and Israel, where tax benefits are provided across all stages, from investment to divestment and reinvestment.

In particular, the UK tax benefit system has several notable features. The system covers all stages of the investment cycle (investment, divestment and reinvestment), is based on tax credits rather than income tax deductions, and is large in scale and even connected to inheritance tax. ₁₀ This is the why the UK’s angel investment to GDP ratio is double that of Korea’s.

Unrestricted Adoption of the CVC System

Would Allow Surplus Funds in Conglomerate’s Holding Companies to be Leveraged

One option to consider is the unrestricted adoption of a Corporate Venture Capital (CVC) system so that surplus capital in conglomerate holding companies could be used for exploring and investing in new industries. This would help to remedy the concentration of innovation in conglomerates by naturally spreading it to SMEs and startups.

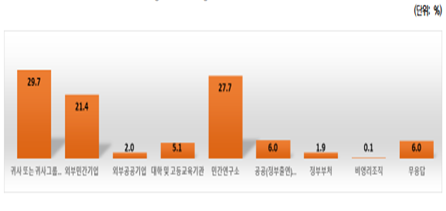

In the corporate capacity section, other factors identified in the survey that undermine innovation include a lack of qualified professionals, ideas and technology, and insufficient information about markets. Lack of internal capacity is a structural issue that is unavoidable for SMEs and startups. The notable part here is external cooperative partners. Figure 8 below outlines the survey findings on the usefulness of outside cooperative partners.

(Source: Science And Technology Policy Institute,

2020 Korean Innovation Survey: Manufacturing section, p92)

According to the KIS survey, the usefulness of government departments, external public enterprises, universities, institutes of higher education and government funded research institutes was far below that of the private sector. This demonstrates the need for establishing an ecosystem where companies can smoothly onboard the talented professionals they need.

In order to create an innovative ecosystem where capacity for innovation spills over from conglomerates to SMEs, a good starting point would be to prioritize greater angel investment in early stage startups through tax benefits.

1) Kim Tae-yu & Kim Yeon-bae, Korea’s Time, Sam&Parkers, 2021

2) Bloomberg, ‘Bloomberg Innovation Index 2021’

3) WIPO, ‘Global Innovation Index 2020’

4) WEF, ‘The Global Competitiveness Index 2019’

5) BCG, ‘The Most Innovative Companies 2021’

6) Clarivate, ‘Top 100 Global Innovators 2021’

7) Lee Jungwoo & Kang Heejong, Science And Technology Policy Institute, ‘2020 Korean Innovation Survey: Manufacturing section’, 30 December 2020

8) Ministry of SMEs and Startups, press release, 27 January 2021

9) GDP Ratio Statistics, 2019

10) Yang Hyeon-bong, Angel Investment Support Systems in Major Developed Countries and Implications, KIET Monthly Industrial Economics, May 2020 edition

< Copyright holder © TAEJAE FUTURE CONSENSUS INSTITUTE, Not available for redistribution >